kdprevent Risk Calculation

Avoiding negative audit remarks and fines

[en] kdprevent Digital Compliance Solution - Risk Analyzer

The time taken to process AML alerts can be quite problematic for financial institutions and corporates having to deal with compliance issues.

AML rules were invented to fight ML and are strongly supported by country regulators. Giving more attention to day-to-day business with admittedly more value-added tasks may make sense for a front user but, in the long run, audit remarks and/or fines negatively impact the reputation and the financial balance of a bank.

A widespread use case

Quoting from a bank manager...

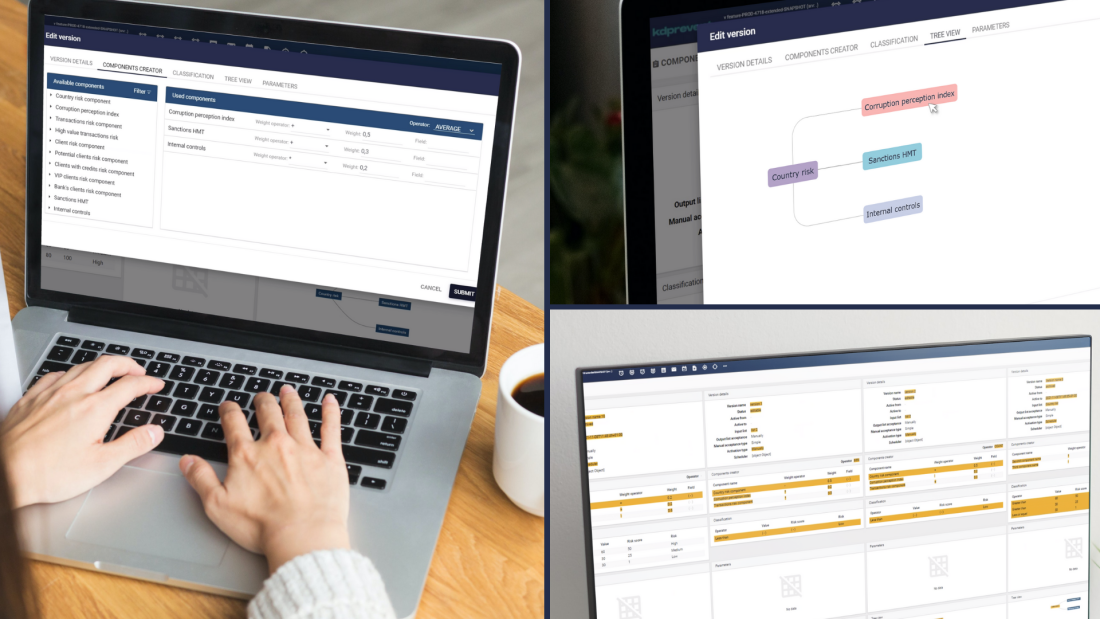

Risk calculation is key

Risk calculation is the most appropriate means to mitigate such vulnerabilities. Inetum’s AML solution includes a risk calculator which takes processing time into consideration and therefore provides a rolling assessment of risks. The more time the emitted alert remains open, the higher is the revised risk level.

Dive deeper into compliance

Our complementary expert features allow businesses to further strengthen their compliance systems. We bring specialised solutions to each of your concerns.

Check out Inetum's take on Financial Compliance

Also, discover our enhanced catalogue below for more information.

They trust us

Over 50 institutions have rolled out our compliance solutions

Let’s meet!

Come and see our solutions and demonstrations at the following events