Cleva Life

CLEVA LIFE

Your challenges, our answers

Cleva Inetum offers insurance companies a much needed agility by creating modular solutions that fit their architecture, eliminating the traditional application restrictions that prevent automation and integration in a digital ecosystem, investing in a digital approach that allows insurance companies to renew their channels, workflows and configuration offer, allowing new types of relationships with the customers and new ways to maximise sales and service opportunities, and retaining a research area known for its innovative nature.

Cleva Solution's flexibility and versatility allow insurance companies to autonomously create and test new insurance products, based on a configuration capability that adapts to the needs of each insurance company, and that does not require specific developments. In practice, this allows insurance companies to launch new products in weeks rather than in months.

Built on state-of-the-art technologies, Cleva Life is the perfect answer to your insurance company’s life products: a core solution with full functional coverage that allows an integrated management of all business lines, including operational, distribution, and information analysis management, designed to integrate with other software systems.

Global solutions for all lines of business (individual and group)

Support to all business processes across functional areas

The entire configuration of the Cleva ecosystem is carried out on our Cleva Product factory module.

Its configuration capacity allows insurance companies to adjust the behaviour of the software to their specific needs, modifying or extending functionality and processes.

Cleva Product factory allows defining and reusing the structure of products, as their behaviour is based on insurance concepts and language.

It includes a business rules engine, the Insurance Business Modelling Language (IBML), which is fully integrated and available in all areas, allowing the configuration of:

- decision-making rules that define product behaviour;

- rules and variables for actuarial calculation;

- a sequence of screens and design rules that respond and readjust according to the product.

Cleva Life addresses the complete life cycle of the policy, supporting all policy management operations from quotation to policy cancellation.

It covers all lines of business, including funds management, as well as individual and group products.

Cleva Life also supports the management of all types of surrender, including full/partial surrenders, programmed surrenders, or policy term.

Cleva Life supports all processes associated with claim management and indemnity settlement, for all claim types.

Cleva Life integrates with Cleva Process factory for full support to claim processes.

Cleva Life supports most billing and collection management operations.

The solution supports numerous payment methods, including bank collection, ATM, treasury, and agent.

Most billing and collection operations can be fully automated and do not require any action from the user.

The behaviour and flow of the processes can be configured according to the needs of each implementation.

This area allows managing reinsurance operations, including premium processing and settlement of indemnities, calculation of mathematical provisions, interest, taxes and returns.

It supports the management of proportional reinsurance treaties (automatic and optional), where the risk is shared by several reinsurers, with the premiums and claims being split according to the negotiated percentage.

Cleva Life provides all features necessary to manage all parties – natural or legal persons – interacting with the insurance company.

It allows configuring the data structure that supports the party concepts and the associated roles, addresses, and bank accounts.

Boost your business

Cleva Life provides full coverage of the life insurance business, providing an end-to-end solution to meet the needs of the company.

The solution incorporates an insightful insurance knowledge that addresses the needs of the insurance business professionals.

Its flexibility and configuration capability allow a quick time-to-market.

The technological platforms on which it is built, and its continuous evolution allow the solution to address market demands in an agile manner.

What do the analysts say about us?

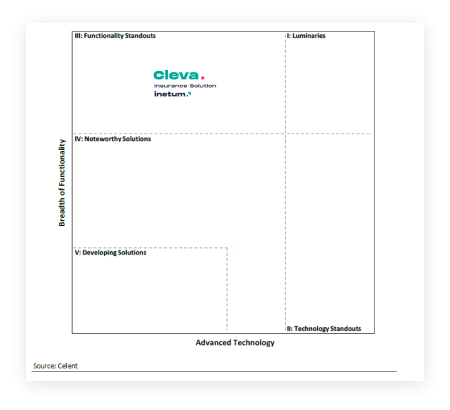

Cleva Life solution was classified by Celent (in Policy Administration Systems: EMEA Life Insurance Edition 2023) as a Functionality Standout:

“Cleva Life is a full end-to-end life policy administration system. Indeed, the vendor has modernized the look and feel of the user interface, improved the claims workflow process, and added support to joint life products. Inetum has also worked on regulatory compliance to meet IFRS17 requirements. Also, a new frontend factory has been added to facilitate the creation of new distribution channels interfaces. A catalogue of reusable workflow has been added, and new APIs for external applications have been developed. On the technical side, updates with a recent version of Angular have been performed as well as other component upgrades (Spring, Hibernate). Security enhancement has also been a major investment, with higher security authentication in web services and updates of components to address critical security vulnerabilities”.

Contact us

Our Offices

Global expertise, vast experience